Money is one of the most important—

but most difficult—family conversations.

This is the latest in a financial education series from your team at Streamline Wealth. In this edition, Streamline Wealth partner Joel Bickmore, CFP®, CIMA®, dissects the difficult topic of how to effectively speak to your children about money.

Why You Must Speak to Your Children about Money

Emotion. Fear of judgment. Complexity. Cultural taboos. Privacy concerns.

Money is one of the most important—but most difficult— family conversations. Despite the challenge, it’s too important to avoid.

Of course, you won’t speak to a 25 year-old the same way you speak to a 10 year-old, so we’ve divided this article into two parts. First, we explore how to talk to your adult children about money: specifically, as it pertains to family finances, estate planning (always a challenge), and ongoing financial support.

In the second half, we shift the focus to young children and how to plant the seeds of financial literacy early in life.

We then finish with a concise list of resources that you can consult to help you more effectively communicate your knowledge about this foundational subject.

Joel Bickmore,

CFP®, CIMA®

Partner, Wealth Advisor

Adult Children: Because They Don't Know What They Don't Know

The topic of money is so difficult for some people to discuss that many regrettably avoid it altogether. Avoiding the topic often leads to misunderstandings, missed opportunities, or hardship later in life.

That’s the negative.

But talking about money gives you a chance to model healthy financial habits. Even one good money conversation can positively impact your child for the rest of his or her life.

We Recommend That You Start With Your "Why"

Before numbers or plans, explain why you’re starting the conversation.

Whether you’re establishing an estate plan, helping your adult child purchase a home, or you’re worried about his or her financial habits, beginning the conversation with patience and caring can reduce defensiveness and launch a freer exchange.

For example, you might start out by saying: “I’ve (we’ve) been thinking a lot about the future, and I/we very much want us all to be on the same page when it comes to our family’s finances.”

Inheritances, the Future, and Setting Boundaries

The concept of a future without you. The legal, financial and tax complexities of efficiently passing along wealth. The fear that a child with an inheritance might lose motivation.

While talking about money and the future is tough, avoiding the subject is usually not the best course of action.

Case in point, often referred to as the “third generation curse,” an astounding 90% of inherited wealth does not make it to the next generation.¹

And the consensus reason for this? A lack of financial education and inadequate communication.

But with some proactivity you can beat the odds.

If your goal is to someday pass on wealth, or to try and redirect a financially irresponsible child, we suggest you approach it with structure. Let your child know what your plans are, and whether you’ve developed a will, a trust, or you intend to transfer wealth via gifts during your lifetime.

Then, clarify what you expect of them (if anything) in return. Many estate plans specify age, educational achievement, work history, or some other meaningful milestone that must be realized before wealth is transferred.

Which brings us back to the fact that many parents worry that disclosing too much financial information might stunt a child’s motivation for embracing challenging work, or it could result in a lackadaisical approach to managing money.

And as the 90% third generation statistics confirm, it is a real thing.

We encourage you to approach the conversation with the intention to guide and not to enable. (And your advisor here at Streamline Wealth would be happy to meet with you and your children to help facilitate these difficult conversations and set expectations.)

Explain YOUR Financial Values and Not Just the Numbers

Talking about money isn’t only about your portfolio. It is about your lifelong decision-making processes. You have created and maintained a standard that has elevated you into a position where you have something to share with your children.

That is no small feat. For example:

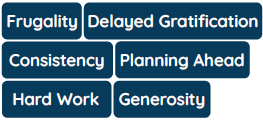

Share and describe the values that shaped your financial habits and have comprised the foundation of your success.

Encourage Their Financial Independence and Accept that it Might Not be Easy

The hardest part of money talks is often just starting them. We encourage you to stay the course and keep the big picture – their future wellbeing – in mind.

Tips for managing tough financial discussions:

- Stay focused on the key issues:

– Your short and long-term plan

– History and reasoning

– Expectation

– Your desire for your children to

thrive - Try and avoid emotion or judgment.

- Stick with facts.

- Try to avoid making spontaneous bargains that you haven’t had time to really consider.

- If it gets emotional, diffuse, step back, and try again later.

Lastly, even though you’re able to help your adult children financially, make certain it doesn’t cost them their independence. This means helping rather than enabling.

Saying “yes” to a child can feel great, but sometimes saying “no” is better overall.

- Offer guidance and tools. Have them meet with your advisor.

- Help them understand the importance of creating a budget.

- Consider offering incentives such as a “match” for saving instead of a handout.

Remember, the overarching goal is not just to give them money (even if you have plenty to spare). As virtually all bankrupt former lottery winners and professional athletes can attest, people who suddenly come into money without proper financial education often end up in a worse situation (unbearable debt levels, for one) than those who have never had much money at all.

The goal is to help your adult children develop a healthy, longterm relationship with money so they can achieve a sense of prosperity, and then hopefully someday have similar conversations with children of their own.

Part Two: How to Speak with Younger Children About Money

Start Early

According to a study by Cambridge University, children begin forming money habits as early as age seven. With kids and money: first share, then show, and then watch them grow.

To provide your kids with a head start, you don’t have to turn your home into a think tank – just begin with simple, age-appropriate lessons and build over time.

Make Cash Visible

Cash. Coins. Rolls of quarters.

Today, one challenge is that kids rarely see physical cash.

We recommend that you use actual physical currency when instructing young children. Let them handle coins. Encourage them to count the bills. Let them see money go in and out of a piggy bank or envelope system.

Talk Openly About Everyday Decisions

Kids are observant. Impressions become imprinted even if they aren’t sure what they are seeing.

Children watch as you buy groceries, pay bills online, or decide whether to purchase something new. Instead of rushing through, explain what you’re doing. Explain that you worked for the money, so it transferred from your employer (or an investment) to your bank or lender, and now you are using that money to buy things that you want or need.

Consider introducing concepts such as: “This pasta is on sale, and it tastes the same as this other brand, so I’ll get this one and we can save that money, or we can use it to buy something else.”

By doing this, you’re showing them how to make decisions and tradeoffs, which are essential skills in money management.

Reinforce the Basics of Earning

Young kids can understand the concept of earning money. Chores, sales, or small projects help kids see how effort turns into money.

In a computer and video-driven world, where hits of dopamine are everywhere, using cause and effect (chore/achievement => reward => feelings of accomplishment) to promote early financial literacy and good decision making can be a useful tool.

This, of course, does not mean you should pay for every chore. This merely builds an understanding that money is earned, that it holds a place of importance in our lives, and that it comes via effort, which all serve to attach greater worth to the reward.

Utilize Age-Appropriate Tools

As your kids grow, introduce them to more sophisticated tools. For example:

- Ages 5–8: Use a piggy bank, or a three-jar system (one each for spending, saving, and giving), and simple conversations.

- Ages 9–12: Open a youth savings or investment account and explain the concept of compound interest.

- Ages 13–18: Introduce budgeting apps and prepaid debit cards, explain stock tickers, watch financial news programs.

To build their comfort and confidence, let them manage increasingly larger budgets for things like school supplies, outings, or clothes to give them real-world experience.

With kids and money: first share, then show, and then watch them grow.

A List of Terrific Books We Recommend for Financial Education and Parenting

Along with our partners at NewEdge Wealth, we have compiled a list of books that support the “children and financial education” topics we’ve introduced in this edition.

And lastly…

Whether your kids are 10 or 30, money conversations pass on values and habits that shape their future success.

These talks are invaluable.

Connect with your advisor at Streamline Wealth for more information or to schedule an appointment for you and your children.

Raised Healthy, Wealthy, & Wise: Interviews With Successful Inheritors.

How to Adult: Personal Finance for the Real World

Children of Paradise: Successful Parenting for Prosperous Families

The Opposite of Spoiled: Raising Kids Who Are Grounded, Generous, and Smart About Money

In Three Generations: A Story About Family, Wealth, and Beating the Odds

Please note that you should not consider the contents of this newsletter to be investment advice, and that this update is for informational and educational purposes only. Please contact us before you make any investment decisions, or if you wish to discuss alternative investments, your asset allocation, your overall financial plan, or anything related to our client-advisor partnership.

As always, we appreciate your loyalty. And we very much look forward to speaking with you soon.

Advisory services offered through NewEdge Advisors, LLC doing business as Streamline Wealth, as a registered investment adviser. Securities offered through NewEdge Securities, LLC, Member FINRA/SIPC. NewEdge Advisors, LLC and NewEdge Securities,LLC are wholly owned subsidiaries of NewEdge Capital Group, LLC.