Longer days, travel plans, sunscreen, and… alternative investments?

This is the first in a financial education series from Streamline Wealth to help you become more familiar with planning and investing. In this article, Streamline Wealth partner Crystal Groover presents alternative investments.

What exactly are alternative investments?

Also known as “alts,” or “non-publicly traded securities,” these are investments that fall outside the traditional categories of stocks and bonds. We will review these five types:

Private Credit

A fast-growing sector of the retail investment landscape, private credit (also known as direct lending) is institutional lending, which most often refers to loans that move from investment funds and finance firms (non-banks) to carefully vetted mid-size companies.

As traditional bank business lending has stagnated under red tape and regulatory pressures – including inflexible loan terms and prohibitive approval processes – with its generally faster access to capital and adaptable terms, private credit has risen to fill the lending void in circumstances where the utilization of traditional banks is no longer advantageous.

How widespread has investing in private credit become?

Assets under management (AUM) in private credit have grown from an estimated $46 billion to over $3 trillion in just 25 years.1 (For the purposes of scale, the most widely available retirement preparation vehicle in America, the half-a century old 401(k) plan, has roughly $8.9 trillion total held by some 60 million people.2)

Crystal Groover

CFP®, ChFC®

Partner, Wealth Advisor

Private Credit

What are the advantages for investors who are allocated into private credit?

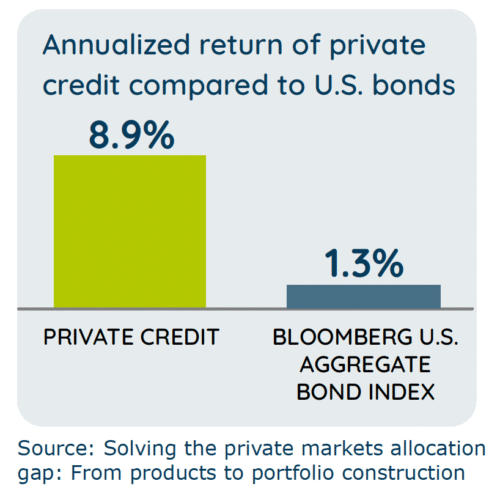

- First, there’s the potential for higher returns (specifically, as you see in the chart, in comparison to fixed income/ bonds).

-

Next, private credit helps investors diversify. (As an investment, it has a low turbulence correlation to publicly traded equities.)

-

Third, it offers access to new markets. (Retail investors can gain exposure to private businesses and real estate projects that they can’t access via public markets.)

-

Lastly, it offers inflation protection. (Some private credit instruments have “floating interest rates,” which can adjust upward when inflation rises.)

One way to think of your position as an investor in private credit is as a partner of a lending group.

Still, even as private credit has exploded in popularity, it is important to note that it is typically less liquid than some other investments, and therefore not suitable for everyone.

Private Equity

One hundred years ago, private equity was the exclusive domain of super high-net-worth investors.

But that has all changed. The modern, accessible private equity investment marketplace now provides retail investors (such as yourself) with exposure to potentially under-the-radar companies that are not publicly traded (listed on an exchange).

What are some advantages of private equity investment?

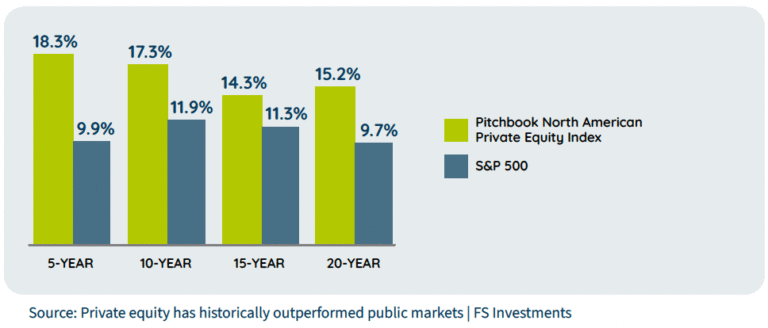

- The potential for higher returns (compared to traditional markets): For example, as seen in the chart, between 2003 and 2023, private equity investment clearly outperformed the S&P 500.4

- A once unavailable level of diversification: By adding exposure to non-publicly traded assets, investors can reduce their correlation to some of the risks and fluctuations (including many of the negative effects of behavioral finance) of publicly traded equities.

- Unique opportunities: Ideally, private equity offers investors exposure to new, innovative, or undervalued companies before they become public.

As an investment sector, private equity may help you avoid the short-term investment mindset that is endemic throughout some publicly traded companies. That’s because, absent the pressures of having to publish positively slanted, hyper-publicized, quarterly earnings reports – which can artificially drive profit or loss – private equity investment can ideally focus on the long-term success of companies who have stronger organizational principles. This makes private equity an option for people who are comfortable with investments that have a longer maturation time horizon.

Private Infrastructure

Recently described by The Alts Institute as the “New essential for investors’ portfolios,” private infrastructure (PI) investing is concerned with the utilization of investor capital to fund private companies that have been selected to build road, transportation, communication, and energy infrastructure projects.

Simply, you’re investing in privately owned firms that build your city’s or your country’s roads, bridges, and energy grids.

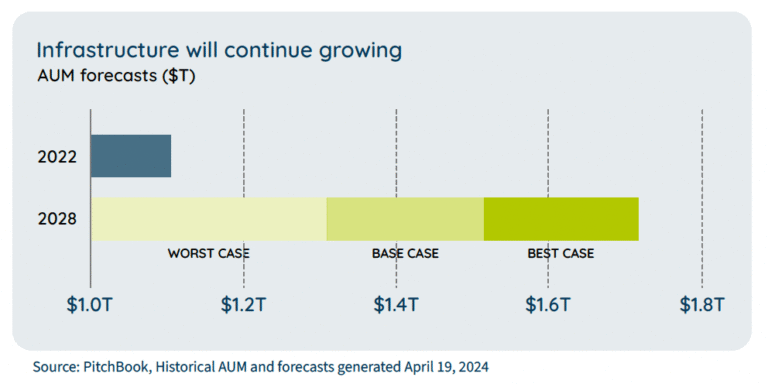

How large is the private infrastructure (PI) investment sector?

However, these growth projections may well be conservative. For example, according to analysts at JP Morgan, there is currently a $2.6 trillion shortfall in private infrastructure capital investment compared to what is already required today to keep up with demand.

But in addition to need, why is private infrastructure a potentially compelling investment?

- First, the innovation and cost efficiencies of private companies are often superior to those of the public (government) sector.

- Second, there is the desire for investors to connect with nonpublicly traded companies.

- Third, technology is both today’s bread and butter, and tomorrow’s promising feast.

That’s because while roads, trains, and bridges are obviously vital, perhaps no aspect of private infrastructure investment is more relevant than its technological applications for the development of energy resource data centers in support of artificial intelligence, cloud computing, and digitalization. (Not to mention actual energy transition services such as electric vehicle charging stations and battery storage.)

These are the simple facts of future demand.

Private Real Estate

The potential for stable cash flow and appreciation? Check.

A low correlation with publicly traded equities? Check.

A hedge against inflation, an increase in tax efficiencies, and the all-important facet of portfolio diversification? Check. Check. And check.

What is private real estate

investment?

Considered income and appreciation-oriented, alternative real estate investments (also known by the catchy moniker “real estate alts”) typically include private funds that invest in real estate properties ranging from warehouses to apartments to office buildings. But unlike direct (or public) real estate ownership/investment, this “alt” offers investors:

- More potential for liquidity.

- A lower investment threshold.

- An approach that delegates both the decision making and the headaches of purchasing and physically maintaining property to experts and managers.

Lastly, at 94% of market share, not only does private US commercial real estate investing dominate the sector (compared to just a 6% share devoted to the public real estate market), at $24 trillion in AUM, commercial real estate is the third largest asset class in the U.S.7

Structured Notes

First created in the mid-1970s in London, a structured note is a debt security issued by a financial institution.

As an alternative investment, structured notes are a hybrid financial instrument that combine a roughly 80% fixed income “bond” element (a debt instrument with a maturity date that offers a predetermined rate of interest) with a roughly 20% embedded derivative component (a type of financial contract whose variable return is determined by an underlying asset).8

Historically associated with wealthy, private banking investors, modern technology has provided greater public access to structured notes, and at a lower cost for investors.

Why utilize structured notes? We may include them in a client’s allocation to:

- Provide an additional layer of diversification beyond a basic 70/30 or 60/40 distribution.

- Provide an entre into markets that are not always simple or easy to access.

-

Provide protection from downturns, but with ample upside possibility. (For example, the roughly 80% “bond” portion of the note emphasizes principal preservation, while the approximately 20% derivative purchase offers exposure to potential returns.)

Lastly, with highly tailorable “hard and soft” protection options (think of these as buffers that work as a shield against market declines), and a global market that exceeds $3 trillion in AUM, while they aren’t suitable for everyone, we believe that the structured note sector is one of the more interesting fixtures in the alternative investment milieu.

Please note that you should not consider the contents of this newsletter to be investment advice, and that this update is for informational and educational purposes only. Please contact us before you make any investment decisions, or if you wish to discuss alternative investments, your asset allocation, your overall financial plan, or anything related to our client-advisor partnership.

As always, we appreciate your loyalty. And we very much look forward to speaking with you soon.

Advisory services offered through NewEdge Advisors, LLC doing business as Streamline Wealth, as a registered investment adviser. Securities offered through NewEdge Securities, LLC, Member FINRA/SIPC. NewEdge Advisors, LLC and NewEdge Securities,LLC are wholly owned subsidiaries of NewEdge Capital Group, LLC.

1 Part I, Private Credit Market Trends: From Originations to Bank Partnerships and Insurance

2 Release: Quarterly Retirement Market Data, Fourth Quarter 2024 | Investment Company Institute

3 Solving the private markets allocation gap: From products to portfolio construction

4 Private equity has historically outperformed public markets | FS Investments

5 Opto | Understanding private infrastructure

6 Private infrastructure | J.P. Morgan Asset Management

7 Private Real Estate Investments: What You Need to Know | KKR

8 What are Structured Notes in investing and how do they work?